What started as a simple computer issue nearly cost one Texas Regional Bank customer and her family $30,000. Like many fraud cases, it began with a moment of confusion—and escalated into a convincing, high-pressure scam.

This cautionary tale highlights how convincing these schemes can be and reveals a few best practices that can help protect you and your family from similar threats.

The Incident

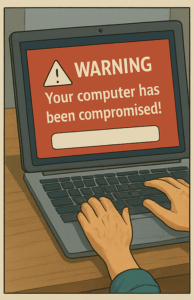

Ms. Jane Doe, a senior citizen, was home alone shopping online for her grandson’s upcoming birthday when it began. Her computer screen froze suddenly, flashing a disturbing warning. Her device had been compromised. A phone number appeared on the screen, urging her to call immediately.

On the other end, a calm voice claimed to be from Microsoft’s fraud department. The supposed agent warned that her financial accounts were at risk, and the only way to protect herself and her family was to withdraw $30,000 in cash and deliver it to a local “support representative.”

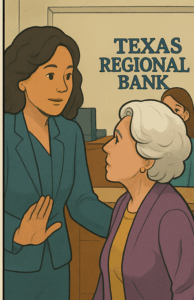

Under the spell of the scammer’s social engineering tactics, Jane visited multiple TRB locations—first claiming the funds were for a property purchase, then for home repairs. At her first two stops, branch administrators were unable to process the transaction with the details provided, due to inconsistencies and growing concern for her safety.

Still believing she was acting in her own best interest, Jane proceeded to a third branch to visit with her account officer. At Jane’s insistence, her withdrawal was processed while the account officer and branch team took the opportunity to educate her—sharing examples of recent scams, common tactics, and what to watch for.

And then, Jane left the bank with the full amount prepared to make the cash drop, and called back her fraudulent ‘support representative’.

The Resolution

Today, education saved Jane Doe.

After leaving the third branch, Jane was broken free from the scammer’s deception when a detail in his instructions made her think twice. “Deposit the cash in a Bitcoin ATM.”

The examples shared by her account officer were still fresh in her mind, and they helped her pause long enough to realize she was making a mistake. She returned to the bank and redeposited the full amount. The scam was stopped, and the funds were recovered.

But many cases don’t end this way. The difference often comes down to one conversation, one team member, or one moment of clarity. If something doesn’t feel right, stop, and talk to the people you know.

The Lesson

According to the FTC, in 2.6 million scams in 2024, consumers lost more than $12.5B. Jane’s story is one of many, and in Jane’s particular case, the scam had already gone too far by the time she left of the bank with the cash.

Jane was deceived, and in her perceived desperation, she had spoken to family, to multiple bankers, changed her story more than once, and still felt certain she was doing the right thing.

Red Flag Action Points

Scammers rely on fear, urgency, and isolation. They coach their victims to avoid questions and to trust no one but the voice on the line. That’s why hesitation—even just a few seconds—is often enough to identify a red flag, and reveal the scam.

- A sudden, urgent warning on a computer or phone screen

- Requests to withdraw large amounts of cash with vague or shifting explanations

- Instructions not to speak with family, bankers, or law enforcement

- Pressure to act quickly or in secret

- Unusual drop-off locations (such as gas stations, remote parking lots, or Bitcoin ATMs)

Takeaways

- Never comply with suspicious or unsolicited requests. Most businesses, and especially banks, will never call you to ask for sensitive information.

- Always confirm and verify with a trusted source. If you didn’t originate the call, hang up, and call a trusted source directly on a known contact number.