Quick Read:

- Captive insurance can provide qualifying businesses with greater control over long-term insurance costs.

- Companies with strong safety records and stable operations are often well positioned for captive structures.

- TRB Insurance helped two industrial clients achieve six-figure annual savings compared to traditional insurance plans.

- Captive strategies can reduce volatility, improve claims management, and create opportunities for investment income on premiums.

Rising insurance premiums and ongoing market volatility continue to challenge businesses across Texas, including companies with strong safety records that still face unpredictable year-over-year costs.

This case study highlights how TRB Insurance used a captive insurance strategy to help two established industrial companies insulate themselves from market swings and generate six-figure savings.

Before hurricane season begins, take time to review insurance policies and confirm that coverage is up to date. Small adjustments now can make the difference between financial stability and prolonged recovery.

In This Article

- The Situation: TRB Client with Rising Insurance Premiums

- The Solution: Captive Insurance Strategy

- The Result: Captive Insurance Pays Off

- Who Can Benefit from Captive Insurance

- The TRB Insurance Advantage

The Situation: Rising Premiums

Two industrial companies in Texas were experiencing significant year-over-year volatility in their commercial insurance premiums. Despite maintaining strong safety records and long-standing insurance relationships, both businesses faced unpredictable costs that complicated budgeting and long-term planning.

The Solution: Captive Insurance Strategy

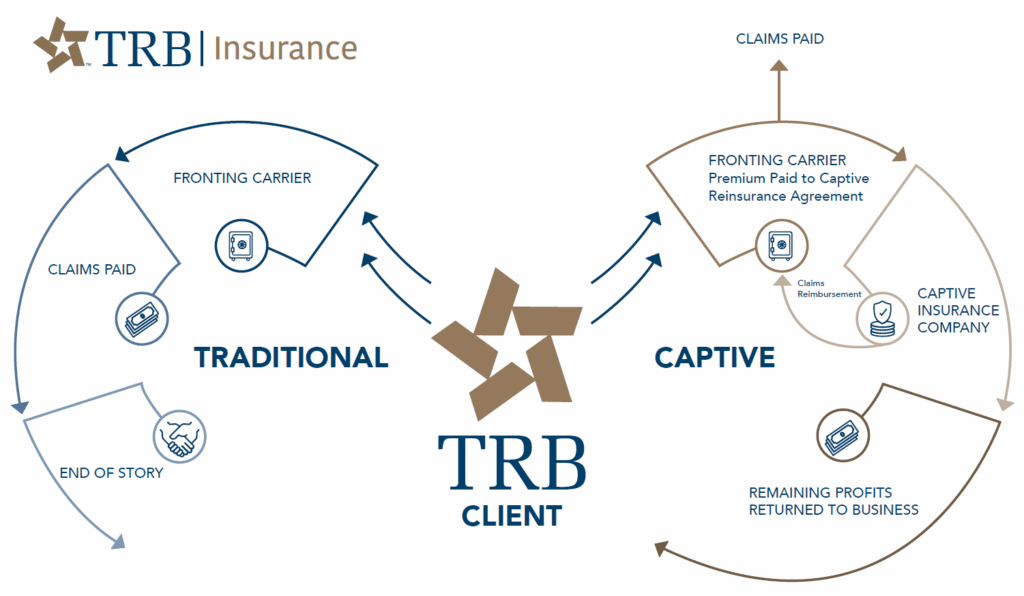

Following introductions through their existing banking relationship, TRB Insurance offered a new perspective, specialized knowledge, and a strategic approach focused on reducing cost volatility and improving long-term control. In both cases, TRB Insurance introduced a captive insurance strategy, enabling ownership and direct oversight of their insurance programs, and shielding them from ongoing market fluctuations. This distinctive structure enhanced loss prevention and claims management, created opportunities to earn investment income on premiums paid, and allowed retention of underwriting profits in years with fewer claims.

What is Captive Insurance?

The Result: Captive Insurance Pays Off

TRB Insurance successfully secured business with both clients by delivering six-figure annual savings compared to their former insurance plans, realizing annual premium reductions of approximately $200,000 and $150,000 respectively.

Beyond annual savings, both clients now have the ability to generate investment income on premiums paid and to retain annual underwriting profits when loss ratios are more favorable than anticipated. This approach positions each company to return millions of dollars in value over time through reduced volatility, improved loss performance, and retained profits.

Who Can Benefit from Captive Insurance?

Captive insurance strategies may be an appropriate fit for other current TRB clients.

- Best in class companies with strong safety and loss histories

- Financially strong businesses with demonstrated operational stability

- Entrepreneurial Owners who think beyond the traditional insurance model

- Organizations committed to safety and proactive risk management

- Companies seeking long-term stability in their insurance strategy and costs

- Businesses with $100,000+ in annual premiums (General Liability, Business Auto, and Workers Compensation ONLY)

If you are not yet a commercial client with Texas Regional Bank, schedule an appointment with our Business Banking team to get started, and learn how to access the full capability of TRB’s financial services.

TRB Insurance Advantage

Captive structures give qualifying businesses a disciplined way to manage long-term risk and create more predictable financial outcomes. For companies facing premium uncertainty, the ability to regain control can become a meaningful competitive advantage.

As a wholly-owned subsidiary of Texas Regional Bank, TRB Insurance is part of a diverse financial services company and is designed to help business owners evaluate options and choose strategies that support their goals. To explore whether a captive approach could benefit your organization, reach out to a TRB Insurance specialist today.

DISCLOSURES: INVESTMENT AND INSURANCE PRODUCTS ARE NOT A DEPOSIT/NOT FDIC INSURED/MAY LOSE VALUE/NOT BANK GUARANTEED/NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY/ARE NOT A CONDITION TO ANY BANKING SERVICE OR ACTIVITY.