At TRB Trust & Wealth Management, a relationship-focused model drives long-term value for families and institutions alike.

For Ricardo Garcia, wealth management is a disciplined practice rooted in clarity, consistency, and trust. A senior advisor in TRB Trust & Wealth Management’s South Texas market, Garcia has spent more than 15 years guiding clients through investment decisions that align with their goals, instead of the latest headlines.

“We’re not here to time the market or sell products,” Garcia says. “We help clients make informed decisions about their capital, based on their needs, their timelines, and their comfort with risk.”

Garcia joined Texas Regional Bank’s Trust and Wealth Management division (TRB Trust & Wealth Management) in 2016, when the department managed approximately $60 million in client assets. Today, TRB Trust & Wealth Management oversees more than $3.5 billion statewide, with a platform built to serve high-net-worth individuals, multigenerational families, and institutions across Texas. Garcia has remained a key part of that growth in the Rio Grande Valley, where his practice continues to reflect TRB’s fiduciary commitment and client-first approach.

In This Article

- A Career Defined by Client Focus

- Translating Strategy into Clarity

- Leveraging a Statewide Platform

- Relationship Management, Redefined

- Education as a Long-Term Investment

- TRB Trust & Wealth Management: Built Around you

A Career Defined by Client Focus

Garcia’s entry into wealth management was pragmatic. In 2009, entering the job market during a recession, he accepted a banker role at Chase that required securities licensing from day one. What began as a foothold in financial services became a clear professional path.

“I was immediately drawn to the investment side,” he recalls. “The opportunity to help someone grow what they’ve earned—that was a meaningful alternative to debt-focused banking.”

Over the years, Garcia developed a generalist investment philosophy with a long-term orientation. His clients include individuals preparing for retirement, young professionals building wealth, and institutional entities with multi-million-dollar mandates. Regardless of size or complexity, Garcia’s process begins with risk tolerance and time horizon.

If you don’t understand the client’s objective, you can’t make a recommendation. Every conversation starts with purpose and ends with alignment.

Translating Strategy into Clarity

One of Garcia’s core competencies is demystifying investment decisions for clients. He is particularly deliberate with first-time investors, taking time to explain fundamentals and establish expectations before discussing product allocation.

“I always ask if they’ve had an investment account before,” he says. “If not, I start at the foundation—what is a stock, what is a bond, what does diversification really mean?”

This consultative approach builds confidence early and reduces client anxiety during periods of market volatility. “We design portfolios to be resilient,” Garcia notes. “If the client’s goals haven’t changed, the portfolio likely doesn’t need to either.”

His clients understand this. Many call to invest additional funds during market downturns, recognizing them as buying opportunities, rather than reasons to retreat. That level of investor behavior, Garcia believes, stems from clarity at the outset.

Leveraging a Statewide Platform

TRB Trust & Wealth Management has expanded its platform significantly in recent years, including the addition of CFAs, CPAs, and other credentialed professionals across the state, including installing division leadership in Houston in April 2024. For Garcia, that scale brings institutional capability without compromising the boutique experience.

We now have in-house experienced professionals we can bring into any conversation. If a client wants to evaluate a concentrated equity position or discuss tax implications from a business sale, we don’t have to refer them outside the firm. We can bring in a TRB colleague who knows the space.

This collaborative structure supports more complex financial planning, including family business transitions, philanthropic structuring, and long-term liquidity management.

“It allows us to serve larger clients with confidence,” Garcia says. “But it also enhances the experience for every client, because we’re never making assumptions, and we’re bringing depth to the table.”

Relationship Management, Redefined

Garcia’s practice is grounded in long-term alignment, not transaction volume. As a fiduciary, he operates independently of commission structures, which gives him the freedom to prioritize client outcomes over product incentives.

When someone tells me they were referred by a friend or family member, that’s the strongest endorsement we can receive. It means we’re not just managing capital—we’ve earned trust.

That trust spans generations. Garcia conducts annual reviews, adjusts portfolios as life circumstances shift, and maintains direct contact with every client. “We’re not a call center,” he says. “I’m the one who answers. I know your portfolio, and I know why we built it that way.”

That same approach scales to institutional clients. TRB currently manages funds for local foundations and endowments that support various missions throughout the Rio Grande Valley.

“Occasionally, I’ve been invited to grant or scholarship galas, and seeing the impact of those funds in the community has been a full-circle moment,” Garcia says. “It’s a reminder that disciplined portfolio management can drive outcomes far beyond returns.”

Education as a Long-Term Investment

Garcia sees education—not performance—as the most underappreciated driver of financial success. That belief shapes how he advises clients, and how he serves the broader community.

Each spring, he volunteers at regional college campuses to teach students the basics of investing. “I tell every class: the best investment I ever made was in education—my own, my kids’, and the people I work with,” he says. “Start early, stay disciplined, and let time work in your favor.”

He and his wife are also active supporters of Access Esperanza Clinics, a nonprofit providing healthcare access across South Texas.

We support the causes that support our community. That’s always been part of how we define service.

For Garcia, whether he’s advising a family, a student, or an endowment, the objective remains the same: to translate financial decisions into long-term clarity and impact.

TRB Trust & Wealth Management: Built Around You

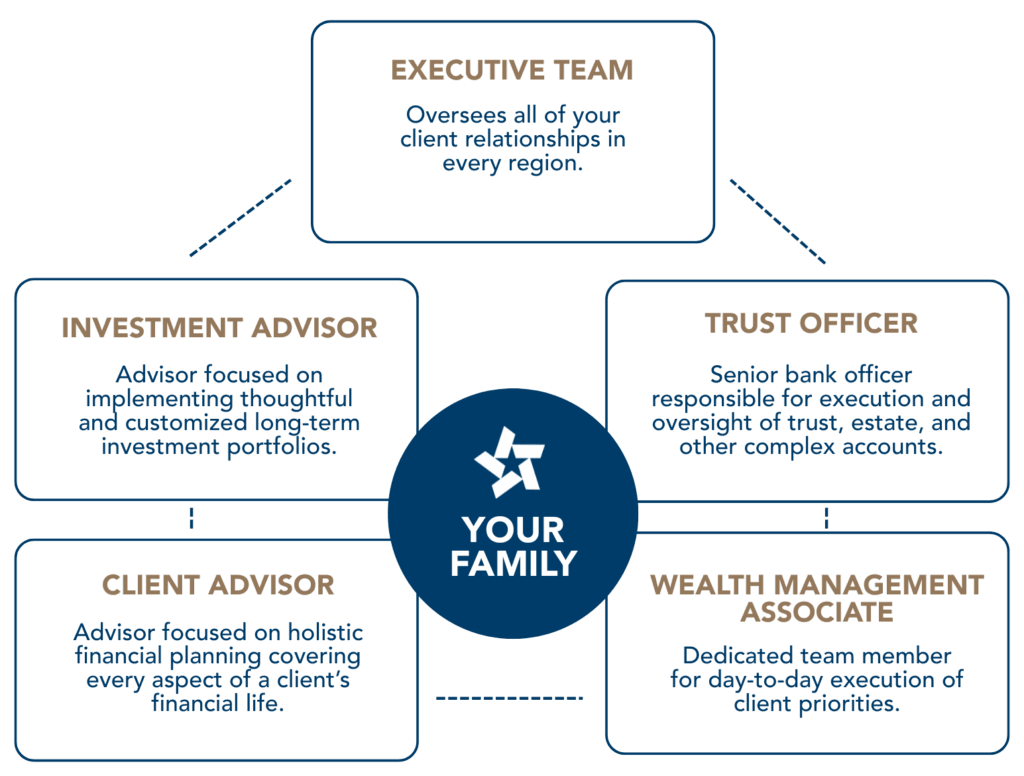

TRB Trust & Wealth Management is a boutique fiduciary division of Texas Regional Bank, providing personalized advice and solutions to help clients manage, protect, and transfer wealth across generations. The team delivers investment management, estate and trust administration, financial planning, and family office services, offering strategies designed to meet complex needs and long-term goals.

To learn how TRB Trust & Wealth Management can help you plan with purpose, visit trb.bank/wealth-management or connect with a member of our advisory team.

DISCLOSURES:

Investment and insurance products: NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

TRB Wealth Management, LLC is a Registered Investment Advisor with the Securities and Exchange Commission

Form CRS | Form ADV | Advisor Info

TRB Wealth Management, LLC does business in the name of TRB Trust and Wealth Management. Trust and Family Office services offered exclusively through Texas Regional Bank. The trust department of Texas Regional Bank has engaged TRB Wealth Management, LLC to provide investment advice to Texas Regional Bank for trust department accounts.