Even as digital banking grows, paper checks remain a common way to pay bills and move money, and that makes them a target for criminals. The American Bankers Association’s (ABA) Practice Safe Checks campaign reports that while check usage has declined by 25 percent, check fraud has nearly doubled since 2021.

At Texas Regional Bank (TRB), we’re reminding customers that financial security starts with awareness no matter how you pay.

In This Article

- Why Check Fraud Happens

- Seven Steps to Write Safer Checks

- If It Feels Off, It Probably Is

Why Check Fraud Happens

Checks contain everything a fraudster needs: your name, address, account number, and signature. When stolen from mailboxes or intercepted in transit, they can be “washed,” copied, or altered to redirect your funds.

“Check fraud may sound old-fashioned, but it’s still one of the simplest ways criminals steal account information,” said Esli Campos, Security and Fraud Officer at TRB. “Treat every check like sensitive data. Protect it, track it, and report anything suspicious immediately.”

Seven Steps to Write Safer Checks

- Use permanent gel pens. Ink that can’t be washed off prevents alteration.

- Avoid blank space. Fill every line so nothing can be added later.

- Limit personal info. Don’t include Social Security or driver’s-license numbers.

- Review your accounts regularly. Early detection helps stop fraud fast.

- Check your checks. Ensure endorsements, amounts, and payees match your records.

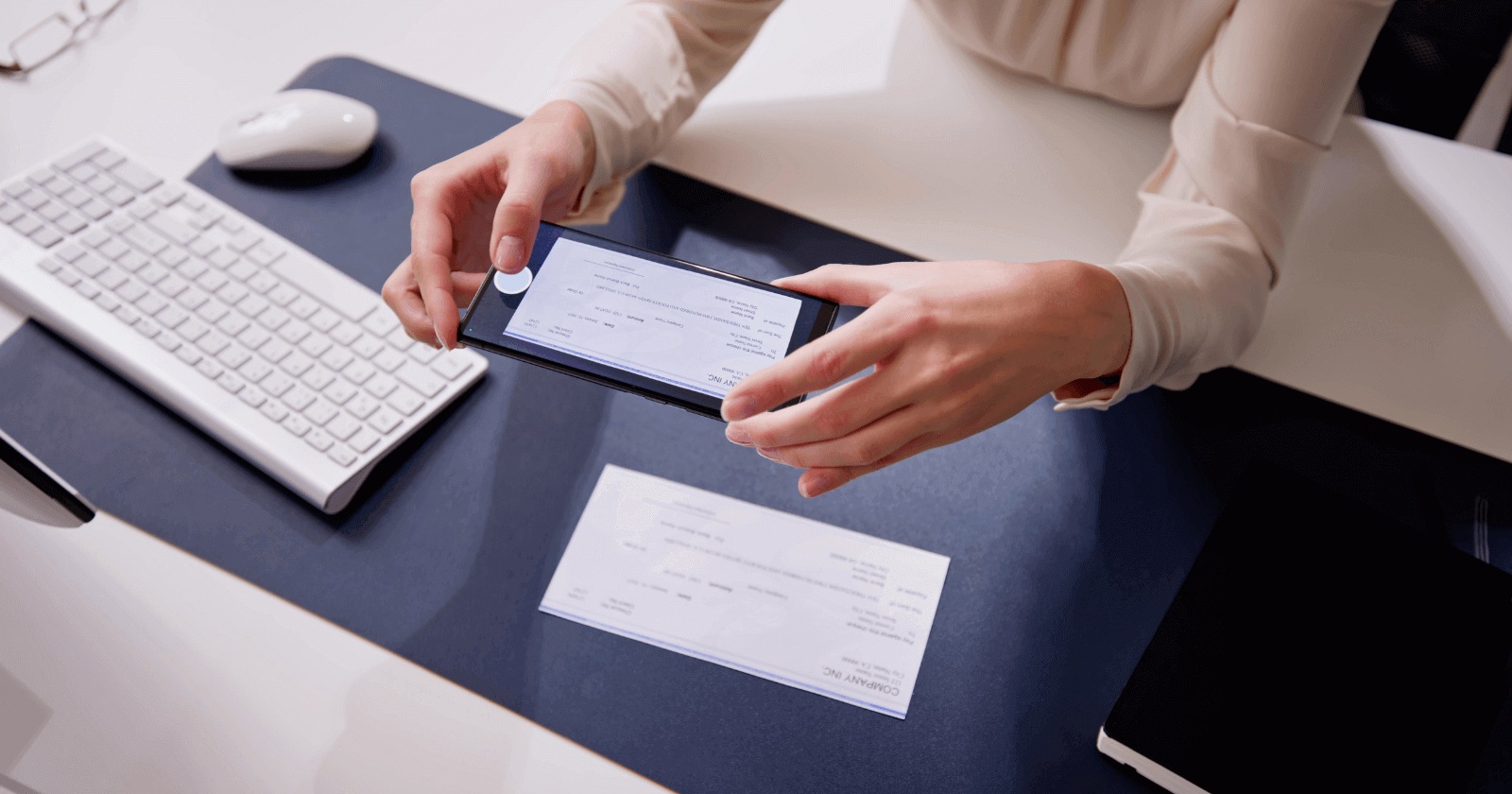

- Use digital payments when possible. Online bill pay or Zelle® in your TRB app is safer and faster.

- Confirm the check cleared with the recipient, especially for larger amounts.

Related: Mail theft remains one of the most common ways thieves steal and intercept checks. Read more about preventing mail theft and check fraud, here.

If It Feels Off, It Probably Is

Mail theft and check-washing schemes often start with simple red flags, like missing mail or altered check images. If you suspect fraud, contact TRB right away. Our team can help secure your accounts and guide you through next steps.

To learn more about keeping your checks safe, visit ABA’s campaign website practicesafechecks.com or visit our Security Archives.