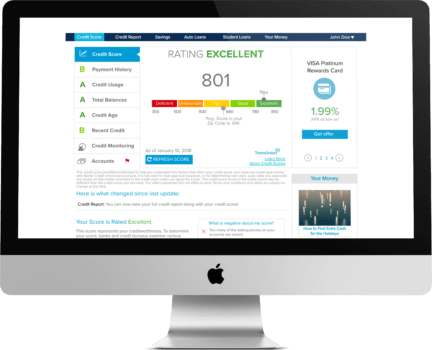

Stay up to date & secure with your Free Credit Score

Texas Regional Bank offers free access to your credit score and detailed credit report. You can refresh your score daily with no impact to your credit.

It’s built right into our already easy-to-use Online Banking and Mobile Banking App, so you don’t need a new login. Benefits of checking your score include the ability to:

ALERTS

Receive monitoring alerts

MONITOR

Monitor credit score

DETAILS

View detailed credit report

How do I see my score?

It’s easy! No new login required – access your score anytime and anywhere!

- Log into online or mobile banking.

- Click the ‘Check Your Score for FREE’ graphic

- Answer 4 quick enrollment questions

- See your score!

Frequently Asked Questions

No. Credit score, reports and monitoring is free for Texas Regional Bank customers.

No. This service uses a ‘soft inquiry’ and will not affect your score. On the other hand, a ‘hard inquiries’ are used by lenders when you apply for a loan to help make decisions about your creditworthiness. Too many hard inquiries may lower your credit score.

Once enrolled, your credit score will automatically update once a month. However, you can update it more often by clicking update on the page that shows your score.

Over 200 factors of a credit report may be taken into account when calculating a credit score. There are three major credit reporting bureaus—Equifax, Experian and Transunion—and different scoring models that determine consumers’ credit scores. Each model may weigh credit factors differently, therefore no scoring model is identical.

TRB works with Savvy Money to deliver your credit score and credit report securely into your online & mobile banking experience.

In addition to our own online & mobile banking security, Savvy Money applies its own security measures and is McAffeeSecureTM, TRUSTe and Norton Secured.

Just you. No one from TRB can see your credit score or credit report; it’s confidential and for you to view securely within online or mobile banking.

No. TRB employees do not have access to individual credit scores.